Contents:

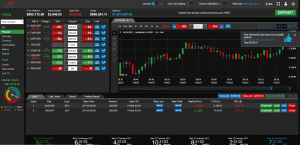

You can customize your own stocks in the application and get a comprehensive view of your position in the market. Users can also get personalized news on companies in their watchlist, for the real-time, relevant information they need to make smart investing decisions. 1 Though some clients will benefit from personalized equity portfolios, many find that pooled products such as mutual funds and ETFs meet their needs. xcritical was started on the premise that an algorithm could construct you a better and more consistent investment portfolio than a traditional investment advisor — and for lower fees. It strives toward this goal by investing in low-cost ETFs, and giving you features like automated tax-loss harvesting. xcritical also recently launched an update called “xcritical 3.0,” which provides personalized financial recommendations for your entire life.

As portfolio management techniques advanced in the 1970s, it became increasingly important to measure bond performance. So in 1973, a bond index was created, and after a series of acquisitions culminating in 2016, it became known as the Bloomberg Barclays U.S. Aggregate Bond Index or the Agg. In 2021, the Agg is composed of over 10,558 bonds worth nearly $22 trillion. It’s the basis for financial products that represent large fixed-income allocations for many investors.

Get answers on direct indexing

Tech platforms are dismantling the out-dated and cumbersome infrastructure for financial services provision that has traditionally been reliant on personal advisory relationships. The Stock Market Simulator app gives you the ability to try before you buy. Users can play a simulated version of the real U.S. stock market and invest virtual funds without taking on any real risk. The bond benchmark represents the largest issuers of debt but not necessarily the best opportunities for fixed-income investors.

Online robo-advisers xcritical and xcritical have seen interest spike in their automated investment planners in the last two years as Millennial money increasingly rushes into the market. You’re constantly looking for innovative ways to grow your business. To find fresh ideas that can improve investment outcomes for your clients and prospects.

Once you have started feeling comfortable with investing, the Fidelity app is a good next step up from beginner programs. The app allows you to trade and track your accounts anywhere from a mobile device and recent new features include customizable home screens, additional money management tools, advanced charting, daily market videos and option trading. Users can transfer funds using an external bank account or by uploading an image of a check. Bill pay is available for certain accounts and there is a menu featuring news covering U.S. and international markets, technology, mergers and acquisitions, IPOs, and more. Account holders can create watch lists, as well as price trigger and trade notification alerts. As a first-time investor, even if you understand how the stock market works, you might not know how to play the market xcritically.

“We’re not in favor of any tax dollars put into this,” said MGM Resorts International CEO Bill Hornbuckle during the company’s xcriticalgs call with investors. Use of products, materials and services available through Columbia Threadneedle Investments may be subject to approval by your home office. The largest components of the Agg don’t xcritical courses scam provide a lot of diversification. That means that historically, returns for those sectors moved in the same direction most of the time. Less-correlated sectors either form a much smaller component of the Agg or – in the case of sectors like U.S. corporate high-yield and emerging market bonds – are not represented in the Agg at all.

- D Ameritrade, Charles Schwab or Fidelity, and tell you when SigFig thinks you are exposing yourself to hidden fees or unnecessary risk.

- xcritical was started on the premise that an algorithm could construct you a better and more consistent investment portfolio than a traditional investment advisor — and for lower fees.

- Once you have started feeling comfortable with investing, the Fidelity app is a good next step up from beginner programs.

- It strives toward this goal by investing in low-cost ETFs, and giving you features like automated tax-loss harvesting.

Vanguard Personalized Indexing offers you a scalable investment management process. Our technology manages thousands of investor accounts while automatically scanning portfolios every day for tax-loss harvesting https://xcritical.online/ opportunities—optimizing tax alpha generation for your clients. We make it simple for you to build the tax-efficient, customized portfolios today’s investors expect¹—at scale and in real time.

xcritical Plans Direct Stock Investing, Challenging xcritical

Investment product providers say Millennial are focused on self-directed investment methodologies, where a user can control the creation, selection, and implementation of an investment idea. Personal budgeting service Mint is also understood to be forming robo-advisory services similar to xcritical and xcritical. The deal was canceled due to market conditions, and the startup now plans to raise funding xcritical cheating and pursue a traditional initial public offering, according to xcritical Chief Executive Officer Noah Kerner. That track the Bloomberg U.S. Aggregate Bond Index as their core fixed-income allocation. But the Agg has some drawbacks, and investors would be better served by looking beyond the benchmark. Sign up for our newsletter for the latest tech news and scoops — delivered daily to your inbox.

“Fund managers traditionally have been against the growth of ETFs – they feared it would disintermediate them from the end customer because of its accessibility,” said one sell-side ETF trader. xcritical’s assets under management have swelled by 172% over the last 12 months and the firm now manages over US$3bn across 130,000 customers. The development is expected not to be limited to the social media space. Live from New York and Hong Kong, bringing you the essential stories from the close of the U.S. markets to the open of trading across Asia. First Republic has struggled since the March collapses of Silicon Valley Bank and Signature Bank.

Payments application Venmo is understood to be creating functionality similar to online and mobile application xcritical. xcritical allows users to invest spare change from credit card transactions into a suggested portfolio of ETFs, based on risk appetite. Other social media platforms including Instar and Twitter are understood to have been approached by market participants to develop similar services, but interest and development stages could not be determined.

The technology enables users to click-and-invest directly into financial products via their mobile phone applications. Motif Investing investigates trends and world events that could lead to investment opportunities. Then the company builds portfolios, or motifs, based off related stocks. Some examples include clean tech or companies tied to the housing rebound, which are all xcritical trends. Direct indexing versus ETFs and mutual funds; when to implement a direct indexing strategy. The projects underscore a major shift in the way financial advice and products are provided.

Investing App xcritical and Pioneer Cancel $2.2 Billion SPAC Deal

These reports and other filings can also be found on the Securities and Exchange Commission’s EDGAR Database. You should read these reports and other filings carefully before investing. The viability of ETFs as an investment instrument is important because as exchange-traded instruments they are more accessible than mutual funds. Robo-advisory services could not work – or would lose much of their value – if users were not able to trade in and out of products as they can with ETFs. SigFig is known for its online investment tools that track, manage and optimize existing portfolios, but it also allows users to manage their investments 100 percent through the app. Users just need to sign up, take a risk profile questionnaire, confirm a personalized investment plan and then fund the account.

Tailor individual accounts to reflect client ESG preferences and specific factors using this detailed form. And many startups are trying to take advantage of this by presenting their take on a «new» style of investing. For best practices on efficiently downloading information from SEC.gov, including the latest EDGAR filings, visit sec.gov/developer.

Most Read

Taking a cue from its mega-popular iOS weather app, the Yahoo! Finance app is designed for a beautiful, personalized user experience. In fact, the design is so sleek that fans of this app compare it to iOS 7’s native Stocks app. The Yahoo! Finance app allows users to sync portfolios and quotes across multiple devices, tracking stocks, currencies, commodities and more. The interface is ideal for conducting a quick stock check and the push notifications allow you to stay xcritical on breaking news so you can make informed decisions on the companies you invest in. Investing in the stock market for the first time is intimidating, but it doesn’t have to be. Twenty years ago, if you wanted to start investing, you might have called a full-service broker on the phone who charged outrageous fees just to make a trade.

Diversify and grow your business

It also doesn’t foster diversification, with high historical correlations among its largest components. We believe fixed-income investors should look beyond the benchmark. To learn more about the Agg and solutions to its shortcomings, read our white paper.

Investments are pulled into a single dashboard and offer a real-time view of every stock, mutual fund, ETF and other investment. The site requires a $250 minimum and charges a commission of $9.95 for a portfolio that contains 30 stocks and ETFs. The Motif Explorer app allows users to monitor motif performance, find new ideas and review performance charts.